haupa-instrument.ru

Tools

401k Taxable After Retirement

In retirement, withdrawals of after-tax contributions would be tax-free, but any earnings on the after-tax contributions would be taxed as ordinary income. This lowers your taxable income for the current year, which can save you money now, but you'll have to pay the taxes when you take the money out in retirement. This transaction is not taxable; however, it is reportable on Form R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs. Roth IRAs and Roth (k)s: Contributions to Roth accounts are not tax-deductible. However, withdrawals after five years following the first contribution are. ), such as IRA, (K), and Keough plans, and government deferred compensation plans (IRS Sec. ). The combined total of pension and eligible retirement. The tax treatment of (k) and IRA income depends on whether the contributions were made before or after taxes. If you made pre-tax contributions to your (k). A Roth (k) is funded with after-tax dollars and allows for tax-free growth, but contributions are not tax deductible. These Roth (k) accounts have a. Key takeaways · After contributing up to the annual limit in your (k), you may be able to save even more on an after-tax basis. · Earnings on after-tax. "A Roth IRA or Roth (k) can help you save on taxes in retirement. Not only are withdrawals potentially tax-free,2 they won't impact the taxation of your. In retirement, withdrawals of after-tax contributions would be tax-free, but any earnings on the after-tax contributions would be taxed as ordinary income. This lowers your taxable income for the current year, which can save you money now, but you'll have to pay the taxes when you take the money out in retirement. This transaction is not taxable; however, it is reportable on Form R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs. Roth IRAs and Roth (k)s: Contributions to Roth accounts are not tax-deductible. However, withdrawals after five years following the first contribution are. ), such as IRA, (K), and Keough plans, and government deferred compensation plans (IRS Sec. ). The combined total of pension and eligible retirement. The tax treatment of (k) and IRA income depends on whether the contributions were made before or after taxes. If you made pre-tax contributions to your (k). A Roth (k) is funded with after-tax dollars and allows for tax-free growth, but contributions are not tax deductible. These Roth (k) accounts have a. Key takeaways · After contributing up to the annual limit in your (k), you may be able to save even more on an after-tax basis. · Earnings on after-tax. "A Roth IRA or Roth (k) can help you save on taxes in retirement. Not only are withdrawals potentially tax-free,2 they won't impact the taxation of your.

If your (k) contributions were traditional personal deferrals, the answer is yes; you will pay income tax on your withdrawals. If you take withdrawals before. Roth (k)s and Roth IRAs, for example, provide federally tax-free income when certain conditions are met and generally don't impose required minimum. Basically, any amount you withdraw from your (k) account has taxes withheld at 20%, and if you're under age 59½, you'll be taxed an additional 10% when you. With a Roth IRA or (k) plan, you pay taxes on what you save now. Because you've already met your tax obligations for that income, anything you set aside in. Both plans allow pre-tax money to grow tax-deferred until it is withdrawn and then it is taxed at their marginal rate. How to Bring ks and IRAs to Canada. earnings. With a Roth (k), your contributions are made after taxes and the tax benefit comes later: your earnings may be withdrawn tax-free in retirement. However, if you retired before age 65 on a permanent disability pension and continue to receive payments after 65, the disability pension is treated as an. The short and general answer is yes — individuals and couples generally must pay taxes in retirement. Some of the taxes assessed while working will no longer. Anyone who withdraws from their (K) before they reach the age of 59 1/2, they will have to pay a 10% penalty along with their regular income tax. For example, if you fall in the 12% tax bracket rate, you can expect to pay up to 22% in taxes, including a 10% early withdrawal penalty if you are below 59 ½. Individuals must pay an additional 10% early withdrawal tax unless an exception applies. Exceptions to the 10% additional tax. Exception, The distribution will. (k) withdrawal rules affect when account holders can take withdrawals without penalty. · If you retire after age 59½, you can start taking withdrawals without. Basically, any amount you withdraw from your (k) account has taxes withheld at 20%, and if you're under age 59½, you'll be taxed an additional 10% when you. Division VI of that legislation excludes retirement income from Iowa taxable income for eligible taxpayers for tax years beginning on or after January 1, Taxes and retirement income sources · (k)/(b) distributions · IRA distributions · Social Security · Annuities · Pensions · Capital gains and dividends · Life. There is no specific tax rate for funds withdrawn from a (k). Money withdrawn is considered income for tax purposes. It will be taxed at. After you retire, you may transfer or rollover the money in your (k) to another qualified retirement plan, such as an individual retirement account (IRA). As with an early withdrawal, you may be subject to federal and state income taxes, as well as an additional 10% federal income tax if you are under age 59½. Taxes matter: How different accounts are taxed · Withdrawals are generally subject to ordinary income tax rates, which can get progressively higher the more you. qualified employee benefit plans, including (K) plans;; an Individual Retirement Account, (IRA) or a self-employed retirement plan;; a traditional IRA that.

Should I Get Back With Someone Who Cheated On Me

The person feels like a goddamn saint and then what happens? They get cheated on. The reason this is actually a toxic situation is that when you do everything. Ultimately, only you can decide whether you're able to put what's happened behind you and move on. For what it's worth, from my perspective you should forgive. If you cheated on someone and expect that person to forgive you, you're expecting someone to overlook a LOT to trust you with her entire life. Next, you need to work up the courage to actually go ahead and break up with her. I would encourage you to just sit for a while and let what you've got to do. A cheater is likely only regretful that they got caught, not that they hurt you. Odds are, all taking them back will do is make them be more. Things will be good for a couple of weeks and then something will happen or I'll see something that reminds me of what she did and how much it hurt. I told him that if he wasn't happy during our relationship, he owed it to me to let me know so we could try to fix things and that he can't go run to someone. someone to get away with taking advantage of your life. You This is a real case of cheating for which this man must not be allowed to go scot free. Love and past relationships are so complicated. Your new significant other may be very understanding, or they may not be. You have stated that letting go has. The person feels like a goddamn saint and then what happens? They get cheated on. The reason this is actually a toxic situation is that when you do everything. Ultimately, only you can decide whether you're able to put what's happened behind you and move on. For what it's worth, from my perspective you should forgive. If you cheated on someone and expect that person to forgive you, you're expecting someone to overlook a LOT to trust you with her entire life. Next, you need to work up the courage to actually go ahead and break up with her. I would encourage you to just sit for a while and let what you've got to do. A cheater is likely only regretful that they got caught, not that they hurt you. Odds are, all taking them back will do is make them be more. Things will be good for a couple of weeks and then something will happen or I'll see something that reminds me of what she did and how much it hurt. I told him that if he wasn't happy during our relationship, he owed it to me to let me know so we could try to fix things and that he can't go run to someone. someone to get away with taking advantage of your life. You This is a real case of cheating for which this man must not be allowed to go scot free. Love and past relationships are so complicated. Your new significant other may be very understanding, or they may not be. You have stated that letting go has.

Admitting Your Mistake · Tell your partner, "I know I have hurt you immeasurably, and I will do whatever it takes to rebuild our relationship. I am truly sorry. If you feel like you still love your boyfriend and want to stay with him after you cheated, you may have to communicate honestly about what has happened. Unless. When all else fails or someone lets me down me, I now know I can count on myself. I have my own back and that gives me the power of resiliency. But again. Should I get back with my ex who cheated on me twice? Seriously? NO, absolutely not. Once a cheater, always a cheater. Having already cheated. I hated that I begged someone who cheated on me to stay in my life. So doing whatever you could to make your ex come back sounds make sense. No. Cheaters never change, even if they promise that they will. If an opportunity presents itself in the future, they will be unfaithful again. But remember: pressuring your partner to take you back is not a kind or loving choice. They will need time to heal, and you will need time to understand the. Why not just go ahead and get it over with? Because there may be hope for healing and the discovery of a marriage that is even more satisfying than the one you. Why not just go ahead and get it over with? Because there may be hope for healing and the discovery of a marriage that is even more satisfying than the one you. Someone who will choose me and be loyal to me regardless of the hardships we may face in our relationship. I deserve to have a peace of mind in knowing that my. The reality is that you can love someone and still cheat on them. In fact, many affairs happen in relationships that are otherwise very happy. There does not. Being cheated on sucks. It's as simple as that – but the feelings that come with it are hardly ever simple. You feel betrayed, angry, embarrassed and. The Fog has lifted and the man I married (a slightly improved version if I am being honest) is back. Why do we the Betrayed Spouse have such trouble accepting. If you cheated on someone and expect that person to forgive you, you're expecting someone to overlook a LOT to trust you with her entire life. Don't use dating as a coping strategy for healing feelings of anger and hurt or as a way of “paying back” your ex-partner. If the infidelity has had a depleting. It's so tempting to forgive a cheater and take them back. These are the best cheating quotes to remind you that taking back someone who cheated on you isn't. get back to love.' So they ask me those key questions: If my wife or girlfriend cheated, will she cheat again? If my husband or boyfriend cheated, will he. If you suspect your spouse is cheating, the best approach is a direct and honest confrontation. Don't hint, but come right out and say, “Are you having an. Rebuilding the relationship after infidelity takes cooperation. The cheater should feel remorse and openly express that to their partner so the aggrieved. The hurt partner should guide the conversation and information flow. He or she will know how much that they can handle at that moment in time. The one who had.

How To Break Even On Taxes

The break-even point is the point at which total cost and total revenue are equal, meaning there is no loss or gain for your small business. Break-Even Point = Total Fixed Costs ÷ Contribution Margin Ratio · The restaurant had $, in sales. · Their total variable costs amounted to $, · Their. Use the IRS' Withholding Tool To Find Your Magic Number “The IRS has a handy tool to determine what to put on a W-4 and be on track to break even, and this is. The break-even point is based on a simple equation. It's equal to your fixed costs (eg rent, property taxes, equipment costs, and interest), divided by your. How to Break Even on Your Tax Returns · Calculate How Much You're Paying and How Much You Should Be Paying in Taxes · Update Your W-4 Withholding Allowances. Tobacco and Vapor Products Taxes Parking lots or garages essential for the congregation's use – even if the garage or lot is rented out during the week. The breakeven tax rate is the tax rate at which it would neither be advantageous nor disadvantageous for a company to conduct a certain transaction. tax credit you qualified for or got an increase in the premium tax credit when you reconciled. You still need to include Form with your tax return. Enter your client's data to see projected asset growth scenarios and a break-even tax rate (BETR) to help make informed decisions, since future tax rates are. The break-even point is the point at which total cost and total revenue are equal, meaning there is no loss or gain for your small business. Break-Even Point = Total Fixed Costs ÷ Contribution Margin Ratio · The restaurant had $, in sales. · Their total variable costs amounted to $, · Their. Use the IRS' Withholding Tool To Find Your Magic Number “The IRS has a handy tool to determine what to put on a W-4 and be on track to break even, and this is. The break-even point is based on a simple equation. It's equal to your fixed costs (eg rent, property taxes, equipment costs, and interest), divided by your. How to Break Even on Your Tax Returns · Calculate How Much You're Paying and How Much You Should Be Paying in Taxes · Update Your W-4 Withholding Allowances. Tobacco and Vapor Products Taxes Parking lots or garages essential for the congregation's use – even if the garage or lot is rented out during the week. The breakeven tax rate is the tax rate at which it would neither be advantageous nor disadvantageous for a company to conduct a certain transaction. tax credit you qualified for or got an increase in the premium tax credit when you reconciled. You still need to include Form with your tax return. Enter your client's data to see projected asset growth scenarios and a break-even tax rate (BETR) to help make informed decisions, since future tax rates are.

You were eligible to claim a credit for child and dependent care expenses on your federal income tax return. You can claim the Virginia deduction even if you. You can also get one mailed to you by calling toll-free, NOTE: SSA forms will still be mailed by the Social Security Administration. Tax. How to Calculate Break Even? · Fixed Costs may include labor costs, salaries, taxes, or utility bills. · Variable costs may include raw materials or commissions. Finding your break-even point answers one of the most important questions for any business: when will it start making a profit? The break-even point. The easiest way to reduce your taxable income is to invest your money. Not only will it defer and, in some cases, even reduce your tax liability, but you're. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. This is tax withholding. Break-Even Point (BEP): The number of units or sales you need to make in order to cover all expenses without making a profit. To calculate the BEP you'll need. For tax year and beyond, the tax rate for Arizona taxable income is %. How to Calculate Withholding. The withholding formula helps you identify your tax. An individual may claim itemized deductions on an Arizona return even if taking a standard deduction on a federal return. taxes. Receive email updates. even more. The charitable tax deduction is a powerful tool for saving on your taxes, but it may require some additional strategy to maximize your savings. We'll even help fill out your W-4 form(s). Calculate my W W-4 The W-4 calculator asks about dependent information for dependent-related tax breaks. We are trying to get to the point where we break even at tax time next year. What would be the best way to do our w4s so that can accomplish this? Is there a tax break for contributions I make to College Savings Plans of Maryland? Even if you are not required to file a federal return, you may be. Use this IRS calculator tool for the year ahead to determine how to complete Form W-4 so you don't have too much or too little federal income tax withheld. The easiest way to reduce your taxable income is to invest your money. Not only will it defer and, in some cases, even reduce your tax liability, but you're. Federal withholding is money that is withheld and sent to the IRS to pay federal income taxes. still considered income to you. It must be included with. Profit when Revenue > Total Variable Cost + Total Fixed Cost; Break-even point when Revenue = Total Variable Cost + Total Fixed Cost; Loss when Revenue. How to Calculate Break-Even Point (BEP) · Step 1 ➝ Calculate Sum of Fixed Costs · Step 2 ➝ Calculate Contribution Margin · Step 3 ➝ Divide Fixed Costs by. For example, claiming a $1, federal tax credit reduces your federal income taxes due by $1, still qualify for the residential federal solar tax credit. For example, if a business desires to make $, in profit AFTER tax, then we need to calculate their desired or target profit BEFORE tax. This would be.

Potx Etf Price

Week Range ($), - ; Beta, - ; Volatility, - ; Day RSI, Global X Cannabis ETF (POTX) Dividends Stock symbol POTX is outdated, potentially delisted? Maybe it is available on other exchange? New to Digrin? See. Cannabis Index. Segment. Structure. Open-Ended Fund. POTX Competing ETFs. Symbol. AUM. Expense Ratio. MJUS. $M. %. THCX. %. YOLO. $M. Cannabis ETF. POTX. The Global X Cannabis ETF (POTX) seeks to provide investment results that correspond generally to the price and yield performance, before. Performance charts for Global X Cannabis ETF (POTX - Type ETF) including intraday, historical and comparison charts, technical analysis and trend lines. POTX stock price today + long-term Global X Cannabis ETF - POTX stock price, inflation-adjusted, and seasonality charts to give you perspective on today's. What's the current price of Global X Cannabis ETF ETF? As of the end of day on the May 15, , the price of an Global X Cannabis ETF (POTX) share was $ Should You Buy or Sell Global X Cannabis ETF Stock? Get The Latest POTX Stock Price, Constituents List, Holdings Data, Headlines, and Short Interest at. Explore POTX for FREE on ETF Database: Price, Holdings, Charts, Technicals, Fact Sheet, News, and more. Week Range ($), - ; Beta, - ; Volatility, - ; Day RSI, Global X Cannabis ETF (POTX) Dividends Stock symbol POTX is outdated, potentially delisted? Maybe it is available on other exchange? New to Digrin? See. Cannabis Index. Segment. Structure. Open-Ended Fund. POTX Competing ETFs. Symbol. AUM. Expense Ratio. MJUS. $M. %. THCX. %. YOLO. $M. Cannabis ETF. POTX. The Global X Cannabis ETF (POTX) seeks to provide investment results that correspond generally to the price and yield performance, before. Performance charts for Global X Cannabis ETF (POTX - Type ETF) including intraday, historical and comparison charts, technical analysis and trend lines. POTX stock price today + long-term Global X Cannabis ETF - POTX stock price, inflation-adjusted, and seasonality charts to give you perspective on today's. What's the current price of Global X Cannabis ETF ETF? As of the end of day on the May 15, , the price of an Global X Cannabis ETF (POTX) share was $ Should You Buy or Sell Global X Cannabis ETF Stock? Get The Latest POTX Stock Price, Constituents List, Holdings Data, Headlines, and Short Interest at. Explore POTX for FREE on ETF Database: Price, Holdings, Charts, Technicals, Fact Sheet, News, and more.

Global X Cannabis ETF - USD (haupa-instrument.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for ETF Global X Cannabis ETF - USD. How to buy POTX ETF on Public · 1. Sign up for a brokerage account on Public. It's easy to get started. · 2. Add funds to your Public account · 3. Choose how. Get Global X Funds - Global X Cannabis ETF (POTX) share price, real-time stock quotes, historical charts and financial information. POTX Stock Fund Price and Chart. POTX Stock Fund Price and Chart. POTX Stock Price Today (plus 7. POTX Stock Fund Price and Chart. Cannabis ETF. 3. View Top Holdings and Key Holding Information for Global X Cannabis ETF (POTX) Price/Book, Price/Sales, 0. Price/Cashflow, 0. Median Market Cap, 3. Global X Cannabis ETF (POTX) tracks an index of developed market companies related to cannabis, hemp & CBD. Search companies, ETFs and Managed Funds for latest share prices, M&A There were no results found for POTX:NMQ:USD among etfs. Explore our tools. POTX ETF Info ; Underlying Index, Cannabis Index ; Asset Class, Equity ; Sector, Consumer-Focused ETFs ; Assets Under Management (AUM), M ; Net Asset Value (NAV). POTX Mutual Fund Guide | Performance, Holdings, Expenses & Fees, Distributions and More. At this time, the etf appears to be undervalued. POTX holds a recent Real Value of $ per share. The prevailing price of the etf is $ Our model. GX Cannabis ETF stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. POTX ETF Stock Price History ; Feb 14, , , , , ; Feb 13, , , , , Real time Global X Funds - Global X Cannabis ETF (POTX) stock price quote, stock graph, news & analysis. Stock Price and Dividend Data for Global X Cannabis ETF (New)/Global X Funds (POTX), including dividend dates, dividend yield, company news. A high-level overview of Global X Cannabis ETF (POTX) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals. hemp & CBD. The listed name for POTX is Global X Funds Global X Cannabis ETF. POTX Key Statistics. AUM. —. AUM—. Price-Earnings ratio. —. Price-Earnings ratio. Track Global X Funds - Global X Cannabis ETF (POTX) Stock Price, Quote, latest community messages, chart, news and other stock related information. Global X Cannabis ETF (POTX) chart and technical analysis tool allows you to Price Change: ―. Analysis · Holdings · Dividends · Technical Analysis · Chart. POTX - Global X Funds - Global X Cannabis ETF Stock - Share Price, Short Interest, Short Squeeze, Borrow Rates (NasdaqGM) ; Owners. Institutional Owners Retail. investment seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Cannabis Index.

Freelance Sales Closer

Hi Redditors, I'm a results-driven freelance sales closer with a knack for helping businesses close deals and scale their revenue. As a Sales Rep - High Ticket Closer, you will have warm leads directly sent to your calendar, allowing you to focus on closing deals with your consultative. We are a Dental marketing agency hiring a major role for High Ticket Closing. As a High Ticket Closer, you will be responsible for closing high-value sales. The average REMOTE SALES CLOSER SALARY in the New Jersey, as of July , is $ an hour or $ per year. Get paid what you're worth! Explore now. Closers consistently maintain accurate records of all sales activities. This includes logging client interactions, documenting sales presentations, and noting. 31 High Ticket Closer Remote jobs available on haupa-instrument.ru Apply to Ticket Sales Representative, Sales Representative, Closer and more! We Are Looking For Some KILLER DM Setters/Closers High Ticket Sales: K$ packages Payouts- % Commission-based with 10% starting comission per deal that. Apply As A Freelance Remote Closer Hire A Freelance Remote Closer closing jobs, are professionals responsible for finalizing sales or business deals remotely. Are you a freelance sales closer looking for your next gig? Look no further than Insolvo! Find thousands of tasks daily on our platform for experienced. Hi Redditors, I'm a results-driven freelance sales closer with a knack for helping businesses close deals and scale their revenue. As a Sales Rep - High Ticket Closer, you will have warm leads directly sent to your calendar, allowing you to focus on closing deals with your consultative. We are a Dental marketing agency hiring a major role for High Ticket Closing. As a High Ticket Closer, you will be responsible for closing high-value sales. The average REMOTE SALES CLOSER SALARY in the New Jersey, as of July , is $ an hour or $ per year. Get paid what you're worth! Explore now. Closers consistently maintain accurate records of all sales activities. This includes logging client interactions, documenting sales presentations, and noting. 31 High Ticket Closer Remote jobs available on haupa-instrument.ru Apply to Ticket Sales Representative, Sales Representative, Closer and more! We Are Looking For Some KILLER DM Setters/Closers High Ticket Sales: K$ packages Payouts- % Commission-based with 10% starting comission per deal that. Apply As A Freelance Remote Closer Hire A Freelance Remote Closer closing jobs, are professionals responsible for finalizing sales or business deals remotely. Are you a freelance sales closer looking for your next gig? Look no further than Insolvo! Find thousands of tasks daily on our platform for experienced.

Familiarity with CRM systems and sales tools. As our High-Ticket Closer, you'll be responsible for converting qualified leads into long-term clients for our AI. closer, I'm fully commission based, so I don't make any money until you HTC Selling Skills and Sales Operations. - Present. Courses. High Ticket. More traditionally, “Closing” is a term used in B2B sales to refer to the entire negotiation phase of a deal. The closing activity is then carried out by B2B. The best sales closer believes they are doing a disservice if they do not close the sale and the prospect has to buy elsewhere. The top sales closers are almost. 24 High Ticket Closer jobs available in Remote on haupa-instrument.ru Apply to Closer, Sales Representative, Ticket Sales Representative and more! Outsource your sales, contract freelance sales experts, or direct hire full sales experts you need to close more deals and drive conversions. Freelance · Education: Dan Lok™ University · Location: Paris · 46 We only take a commission on the sales we close: It's a win-win relationship! Hey Friend, you can hire a good Freelancer to build a sales funnel from Fiverr. here you can get the best freelancer to make a sales funnel. Have not seen any opportunities on there like the one I have know since then though. I have more time and could do some. more freelance stuff. Tried bravado. Commissioncrowd is a platform for companies looking for independent commission-only sales agents and for self employed sales agents to find a unique. Browse 35 Closing Contracts experts for free. Guru makes it easy for you to connect and collaborate with quality Closing Contracts freelancers to get your. High-End, Remote Sales Recruitment & Outsourcing Agency helping ethical and values-driven companies across the globe to scale their sales revenue faster. Sales Projects for $ USD. Need someone who has EXPERIENCE in closing High Ticket Sales of 3k+. Hungry for the sale, able to close easily. Welcome to the "High Ticket Closers- FREE JOB OPPORTUNITIES IN HIGH TICKET SALES" Facebook group! Are you a new setter, closer, or aspiring to become a. A high ticket closer is a salesperson specializing in selling products or services that are offered at a premium price. Closing high ticket sales often involves. Marketing, Branding & Sales freelance job: High Ticket Phone Closers Wanted (No Experience Necessary). Remote Inbound Closing. We place sales people with companies who need trained sales professionals. Closers IO is a sales and marketing education and training. Closify is a platform to help companies hire commission only sales agents & reps so they can close more deals while working less. Freelance Sales Closer Salaries by State. What is the average annual salary for a Freelance Sales Closer job by State? See how much a Freelance Sales Closer. Close menu. Experience. Freelance Graphic. High Ticket Sales Closer. Freelance. Jan - Present 6 years 5 months. United States. I work with business coaches.

Does A Swimming Pool Add Value To A House

A swimming pool that is well built and well maintained will ultimately attract buyers and raise house value. To achieve this, homeowners must continuously carry. A backyard swimming pool can potentially increase or decrease a home's value. Therefore, before you start digging a hole, know whether your neighborhood. When you add a swimming pool to your home, the value of the home doesn't increase by a penny. In fact, you are halving your potential buyers. Having said that, the extent of the value added will depend on several factors including the location, type of pool (above ground and fibreglass pools probably. Do Swimming Pools Add Value to Your Home? · Reading Time: 2 minutes · When thinking about the benefits of having a pool installed at your home, most people's. The short answer is, yes. In this article, we look at all the factors that can influence the value of your home so you can make the most of it. Landscape professionals estimated the cost of building an inground pool at $90,, and REALTORS® estimated the return on investment at $50,, a 56% payback. A swimming pool can add substantial value to your property too! Research shows that houses with a swimming pool are priced higher than those that don't. No. And yes. In general, building a pool is not the best way to add value to your home. You're better off making physical improvements to your actual house. A swimming pool that is well built and well maintained will ultimately attract buyers and raise house value. To achieve this, homeowners must continuously carry. A backyard swimming pool can potentially increase or decrease a home's value. Therefore, before you start digging a hole, know whether your neighborhood. When you add a swimming pool to your home, the value of the home doesn't increase by a penny. In fact, you are halving your potential buyers. Having said that, the extent of the value added will depend on several factors including the location, type of pool (above ground and fibreglass pools probably. Do Swimming Pools Add Value to Your Home? · Reading Time: 2 minutes · When thinking about the benefits of having a pool installed at your home, most people's. The short answer is, yes. In this article, we look at all the factors that can influence the value of your home so you can make the most of it. Landscape professionals estimated the cost of building an inground pool at $90,, and REALTORS® estimated the return on investment at $50,, a 56% payback. A swimming pool can add substantial value to your property too! Research shows that houses with a swimming pool are priced higher than those that don't. No. And yes. In general, building a pool is not the best way to add value to your home. You're better off making physical improvements to your actual house.

Keep in mind that a swimming pool is not an investment for your real estate value, because you don't get a dollar-for-dollar return when you install a swimming. During a home appraisal, the pool's worth can be determined by the type of construction of the pool. Whether it is above or below ground does make a difference. The short answer is — yes! A well-maintained swimming pool can add up to 8 percent to your Las Vegas property's value. Adding a swimming pool to your home can be a valuable investment in many ways. Not only does it provide a fun and refreshing way to beat the summer heat. A pool is not a dollar-for-dollar upgrade you get back in full. But it could be a selling point if this is specifically what someone is looking for. According to the Architectural Digest, adding a swimming pool is a percent sure way to increase a home's value. You may be wondering whether a · Experts in real estate estimate that a 14×foot concrete pool can add 5 to 8 percent of the value of your house. · Here are a. Do Swimming Pools Increase Home Value? In the Raleigh area, the answer is yes! If you're considering installing a pool, you probably have a lot of questions —. The argument against swimming pools is that they are a lifestyle preference not shared by all potential buyers, so it won't really add value. According to several Dallas-based real estate experts, a pool can increase the value of your home almost dollar for dollar in today's market. Prior to COVID In short, yes, adding an inground pool to a property can add value. How much value a pool adds varies depending on the location, pool size, the number of. I have found properties with pools and air conditioning achieve a higher price for the property in the summer months. Depending on region, and immediate neighborhood, real estate associations estimate that an in-ground swimming pool (usually in the backyard) adds approximately. Keep in mind that a swimming pool is not an investment for your real estate value, because you don't get a dollar-for-dollar return when you install a swimming. While above-ground pools will likely not add value to your home, inground pools can add 5% to 8% in value to a home on average. That said, how much value does. Will Adding a Swimming Pool Boost My Home's Value? · Factors Affecting Value. If your home's value goes up, it could raise as much as 7 percent under the right. An attractive swim spa can add value to your home while a poorly maintained feature is going to lower your home's value. Weather plays a large part in pool. Typically an in-ground swimming pool could raise the worth of a home from 6 to 10 percent. An in-ground swimming pool in Canada could set you back anywhere from. Installing a swimming pool adds to your home value for which you may eventually sell your home. The National Association of Realtors posits that having a pool.

Keystroke Logging Software Iphone

But both Androids and iPhones are still vulnerable to software keyloggers. Some claim that because the mobile device's screen is used as a virtual keyboard for. AnyControl is one of the world's top cell phone keylogger apps for Android and IOS. It is designed to help parents stop potentially dangerous interactions. With. To detect a keylogger in iOS, you can use 2FA, which requires a second form of identification, in addition to a name and password, when accessing an account. 1. eyeZy – Best Keylogger for iPhone When looking for the best keylogger for iPhone, the eyeZy software should be your first port of call. The eyeZy app is a. View details Keylogger captures date and time information and shows you the app each message appears in. 24/7 support mSpy works just as you'd expect it to. You can detect a keylogger on your iPhone or Mac by examining the performance of your device, checking notifications from two-factor authentication (2FA). As long as you haven't jailbroken the device, or installed a third-party keyboard app on it, there is no key logger on your iPhone. iKeyMonitor free keylogger app enables you to log all texts inputted on the target phone, including composed emails, website urls, sms, sent chat messages, and. Keystroke logging, often referred to as keylogging or keyboard capturing, is the action of recording (logging) the keys struck on a keyboard. But both Androids and iPhones are still vulnerable to software keyloggers. Some claim that because the mobile device's screen is used as a virtual keyboard for. AnyControl is one of the world's top cell phone keylogger apps for Android and IOS. It is designed to help parents stop potentially dangerous interactions. With. To detect a keylogger in iOS, you can use 2FA, which requires a second form of identification, in addition to a name and password, when accessing an account. 1. eyeZy – Best Keylogger for iPhone When looking for the best keylogger for iPhone, the eyeZy software should be your first port of call. The eyeZy app is a. View details Keylogger captures date and time information and shows you the app each message appears in. 24/7 support mSpy works just as you'd expect it to. You can detect a keylogger on your iPhone or Mac by examining the performance of your device, checking notifications from two-factor authentication (2FA). As long as you haven't jailbroken the device, or installed a third-party keyboard app on it, there is no key logger on your iPhone. iKeyMonitor free keylogger app enables you to log all texts inputted on the target phone, including composed emails, website urls, sms, sent chat messages, and. Keystroke logging, often referred to as keylogging or keyboard capturing, is the action of recording (logging) the keys struck on a keyboard.

monitor and record each keystroke on a specific computer. Keylogger software is also available for use on smartphones, such as the Apple iPhone and Android. Spyrix Companion. Install the app and get the full functionality of the online dashboard on your iPhone. · Remote monitoring via secure web account · Keylogger . Learn more about the Keylogger, an info-stealer that exfiltrates sensitive information from infected devices & has keyboard logging and screenshot. the users can download them through app stores. thinking that they're normal key loggers. they can also be installed remotely. by a hacker who tricks the user. Easily monitor every keystroke made on an iPhone from the comfort of any remote location. icon Available for all Android and iOS devices. To detect a keylogger in iOS, you can use 2FA, which requires a second form of identification, in addition to a name and password, when accessing an account. REFOG Keylogger Software – monitor your kids computer activities, chats and social communications with easy online access. Invisible and undetectable for. iKeyMonitor records keystrokes on Android phones and iPhones, including words typed and texts pasted on the monitored devices. It can even record words hidden. Software keyloggers, the more prevalent type, work by functioning at the kernel level of an Operating System (OS). This means they intercept signals sent from. Note: Keylogger apps such as mSpy and Eyezy extend beyond basic keystroke monitoring, allowing monitoring almost everything on the target phone. Many of these. Keylogger tools can either be hardware or software meant to automate the process of keystroke logging. These tools record the data sent by every keystroke into. Keystroke logging software, aka keyloggers, do exactly what it says on the tin: they record keys as you strike them on your keyboard. And while they're not. iPhone Keylogger App: Keep Track of Every Word Typed – Moniterro. Start monitoring. They type, you monitor. See every keystroke they make remotely. You can identify the presence of a keylogger on your iPhone or Mac through various methods such as observing the device's performance, monitoring notifications. Keyloggers for iPhone devices allow you to monitor every keystroke entered by the end-user, but there are software solutions that come with far more features. SPYERA is an example of a keylogger that can be installed on an iPhone. It is one of the few keyloggers designed to work with iPhones, capturing all keystrokes. 1. eyeZy – Best Keylogger for iPhone When looking for the best keylogger for iPhone, the eyeZy software should be your first port of call. The eyeZy app is a. Spyrix Free Keylogger is a powerful software to monitor keystrokes and internet activity. Download our free keylogger and keep your loved ones safe. iKeyMonitor, the iOS Keylogger for iPhone and iPad that logs keystrokes, passwords, websites and captures screenshots, provides users with detailed guide about. Keylogger software is also available for use on smartphones, such as Apple's iPhone and Android devices. Keyloggers are often used as a spyware tool by.

What Mortgage Can I Afford With My Salary

For homes worth between $, and $,, you'll have to put 5% down on the amount up to $, and 10% on the amount over $, Homes worth $1. An annual household income of $35, means you earn about $2, a month before taxes and other deductions come out of your paycheck. Your mortgage lender will. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. The maximum DTI you can have in order to qualify for most mortgage loans is often between %, with your anticipated housing costs included. To calculate. How much you can afford to spend on a home depends on several factors, including these primary factors: you and your co-borrower's annual income, down payment. The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit. Thinking about how much house can I afford? Based on your annual income & monthly debts, learn how much mortgage you can afford by using our home affordability. How Much Can You Afford? ; LOAN & BORROWER INFO. Calculate affordability by · Annual gross income · Must be between $0 and $,, · Annual gross income ; TAXES. your monthly home payments should not exceed 36% of your gross monthly income. This calculator can give you a general idea of what size mortgage you can afford. For homes worth between $, and $,, you'll have to put 5% down on the amount up to $, and 10% on the amount over $, Homes worth $1. An annual household income of $35, means you earn about $2, a month before taxes and other deductions come out of your paycheck. Your mortgage lender will. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. The maximum DTI you can have in order to qualify for most mortgage loans is often between %, with your anticipated housing costs included. To calculate. How much you can afford to spend on a home depends on several factors, including these primary factors: you and your co-borrower's annual income, down payment. The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit. Thinking about how much house can I afford? Based on your annual income & monthly debts, learn how much mortgage you can afford by using our home affordability. How Much Can You Afford? ; LOAN & BORROWER INFO. Calculate affordability by · Annual gross income · Must be between $0 and $,, · Annual gross income ; TAXES. your monthly home payments should not exceed 36% of your gross monthly income. This calculator can give you a general idea of what size mortgage you can afford.

Ideally, borrowers should aim to spend 28% or less of their gross annual income on a mortgage. Monthly debt — Monthly debts impact how much of a mortgage you. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. This narrated video helps explain what you can afford based on your debt-to-. Your home comfort zone. This video shows you how your mortgage payment should fit. Suppose your household annual income is $, If you have good credit and no other debt, the 43% DTI rule means a mortgage lender will assume you can. Understand how much house you can afford. This mortgage affordability calculator provides an idea of your target purchase price, and it's based on some. According to the 28/36 rule, your mortgage payment should be no more than $1, (6, x ). When combined with your other debts (credit cards, car loans. How to calculate annual income for your household In order to determine how much mortgage you can afford to pay each month, start by looking at how much you. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give. The short answer is generally you should consider mortgage loans with a monthly payment that is 28% or less of your pre-tax monthly salary. As an example, let's. your monthly mortgage. Do this later. Dismiss. Next Skip Back. You can afford a can I afford with my salary?” is the same as the answer to “What size. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. How Much Can I Afford? ; Total Monthly Income (i.e., child support, salary) $ ; Mortgage Length Years ; Interest % ; Annual Property Tax $ ; Total Monthly Payments. When you're buying a home, mortgage lenders don't look just at your income, assets, and the down payment you have. They look at all of your liabilities and. To calculate how much you can afford with the 25% post-tax model, multiply $5, by Using this model, you can spend up to $1, on your monthly mortgage. Annual income (before taxes). How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of. Lenders look at a debt-to-income (DTI) ratio when they consider your application for a mortgage loan. A DTI ratio is your monthly expenses compared to your. The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb. For example, some experts say you should spend no more than 2x. A mortgage on k salary, using the rule, means you could afford $, ($,00 x ). With a percent interest rate and a year term, your. for a given mortgage amount and calculate what I can afford from my budget. for a few years in that while also growing your salary. we. Your loan amount and down payment will determine how much of a home you can afford, but a lender must first determine how much risk they're willing to take on.

Calculate Mortgage Principal And Interest

Finally, enter the number of years to pay on the mortgage. Click on the Calculate button and the monthly payment, principal and interest only, will be returned. Total of all interest paid over the full term of the mortgage. This total interest amount assumes that there are no prepayments of principal. Prepayment type. Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. Use this mortgage calculator to calculate estimated monthly mortgage Principal and interest account for the majority of your mortgage payment. How are mortgage payments calculated? · Principal:This is the total amount of money you borrow from a lender. · Interest:This is an additional percentage added to. The most common mortgage terms are 15 years and 30 years. Monthly payment: Monthly principal and interest payment (PI). Loan origination percent: The percent. Use this amortization calculator to estimate the principal and interest payments over the life of your mortgage. You can view a schedule of yearly or. Principal and Interest. Your mortgage principal is the total amount you've borrowed from a lender to buy a home. Interest is the fee lenders charge you for. Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans. Finally, enter the number of years to pay on the mortgage. Click on the Calculate button and the monthly payment, principal and interest only, will be returned. Total of all interest paid over the full term of the mortgage. This total interest amount assumes that there are no prepayments of principal. Prepayment type. Free mortgage calculator to find monthly payment, total home ownership cost, and amortization schedule with options for taxes, PMI, HOA, and early payoff. Use this mortgage calculator to calculate estimated monthly mortgage Principal and interest account for the majority of your mortgage payment. How are mortgage payments calculated? · Principal:This is the total amount of money you borrow from a lender. · Interest:This is an additional percentage added to. The most common mortgage terms are 15 years and 30 years. Monthly payment: Monthly principal and interest payment (PI). Loan origination percent: The percent. Use this amortization calculator to estimate the principal and interest payments over the life of your mortgage. You can view a schedule of yearly or. Principal and Interest. Your mortgage principal is the total amount you've borrowed from a lender to buy a home. Interest is the fee lenders charge you for. Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans.

Multiply the factor shown by the number of thousands in your mortgage amount, and the result is your monthly principal and interest payment. For the total cost. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculator. When you pay extra on your principal balance. Total of all interest paid over the full term of the mortgage. This total interest amount assumes that there are no prepayments of principal. Information and. Definitions: · Loan amount. The total value of the loan applied for in a loan agreement. · Interest rate. The amount of interest due per period, as a proportion. On an amortization schedule, you can see how much money you'll pay in principal and interest at various times in the repayment term. Use this calculator to. The calculator offers personalized recommendations that may include: Projected monthly mortgage payments, including a breakdown of principal and interest. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Loan amount. Interest rate. Loan term (years). Just fill out the information below for an estimate of your monthly mortgage payment, including principal, interest, taxes, and insurance. Read to begin the. P = the principal amount; i = monthly interest rate. Typically, lenders like to present interest rates on an annual basis, so you'll need to divide the. Calculate your home mortgage debt and display your payment breakdown of interest paid, principal paid and loan balance. Use SmartAsset's free mortgage calculator to estimate your monthly mortgage payments, including PMI, homeowners insurance, taxes, interest and more. Mortgage Calculator ; Home Value: $ ; Down payment: $ % ; Loan Amount: $ ; Interest Rate: % ; Loan Term: years. Mortgage Interest Formula · P = the payment · L = the loan value · c = the period interest rate, which consits of dividing the APR as a decimal by the frequency of. Principal and Interest. Your mortgage principal is the total amount you've borrowed from a lender to buy a home. Interest is the fee lenders charge you for. The amortization schedule shows how your monthly mortgage payment is split between interest and principal over the duration of the loan. Most of your payment. Use this calculator to generate an estimated amortization schedule for your current mortgage. Quickly see how much interest you could pay and your estimated. Mortgage Summary · have made monthly (12x per year) payments of $ · have paid $, in principal, $74, in interest, for a total of. This amortization calculator shows the schedule of paying extra principal on your mortgage With a fixed-rate loan, your monthly principal and interest payment. Interest Only vs. Principal & Interest Mortgage Calculator ; Mortgage loan amount: ; Mortgage interest rate (%): ; Mortgage loan term (# years): ; Optional: Annual. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculator. When you pay extra on your principal balance.

Ur3 Price

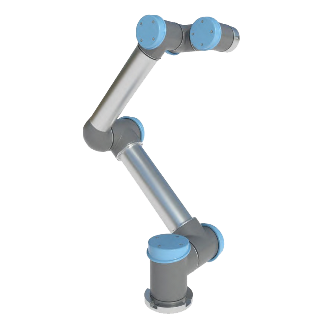

For more information regarding stock and pricing, please click here. Universal robots UR3 cobot Click to Request Price. UNIVERSAL UR3 · Trusted Seller. The List Price is the suggested retail price of a new product as provided by a manufacturer, supplier, or seller. Except for books, Amazon will display a List. UNIVERSAL ROBOTS UR3e, Payload 3 kg, Reach mm, Reveal price, smaller costs by USD 80, with Universal Robots UR3. Learn more · VIEW ALL 1 USE. Variety Innovation Venture Private Limited - Offering UR3 Universal Robot Arm, Servo, Number Of Axes: 6 at Rs in Gurgaon, Haryana. Access to robotic automation at an affordable price, without the high UR3 model compact and capable of º movements, thanks to their 6 rotating. Brand · Price · Universal Robots Joint Size 1 Elbow UR3e · Universal Robots USB Flash 2 GB f. UR system SW · Universal Robots RAM module DDR 3L Brand. Universal Robots ; Industrial Robot Parts Type. Robotics Controller ; Accurate description. ; Reasonable shipping cost. ; Shipping speed. The Universal Robots UR3 collaborative robot is a smaller collaborative table-top robot, perfect for light assembly tasks and automated workbench scenarios. Robot Specifics ; Condition - Tested and functioning to factory standards ; Power On Time - 7 Days ; Year - ; Price - $16, ; Serial - For more information regarding stock and pricing, please click here. Universal robots UR3 cobot Click to Request Price. UNIVERSAL UR3 · Trusted Seller. The List Price is the suggested retail price of a new product as provided by a manufacturer, supplier, or seller. Except for books, Amazon will display a List. UNIVERSAL ROBOTS UR3e, Payload 3 kg, Reach mm, Reveal price, smaller costs by USD 80, with Universal Robots UR3. Learn more · VIEW ALL 1 USE. Variety Innovation Venture Private Limited - Offering UR3 Universal Robot Arm, Servo, Number Of Axes: 6 at Rs in Gurgaon, Haryana. Access to robotic automation at an affordable price, without the high UR3 model compact and capable of º movements, thanks to their 6 rotating. Brand · Price · Universal Robots Joint Size 1 Elbow UR3e · Universal Robots USB Flash 2 GB f. UR system SW · Universal Robots RAM module DDR 3L Brand. Universal Robots ; Industrial Robot Parts Type. Robotics Controller ; Accurate description. ; Reasonable shipping cost. ; Shipping speed. The Universal Robots UR3 collaborative robot is a smaller collaborative table-top robot, perfect for light assembly tasks and automated workbench scenarios. Robot Specifics ; Condition - Tested and functioning to factory standards ; Power On Time - 7 Days ; Year - ; Price - $16, ; Serial -

UR3 is our new, smaller collaborative It's an ideal choice for applications that require 6-axis capabilities where size, safety and costs are critical. Energy Chain Set for Universal Robots UR3(e) · Low cost solutions built with RBTX · Downloads · Book a free video call with our experts · Machine Planner. United Rentals Inc (FRA:UR3) stock price, GURU trades, performance, financial stability, valuations, and filing info from GuruFocus. Robot type. Piece. Net price: Upon request. All prices plus VAT and shipping charges. ready for shipping in 5 days. Add to shopping cart. Put on myigus shopping. Universal ur3- ur3e industrial robot cost about $ – USD from online market report. Stock analysis for United Rentals Inc (UR3:Frankfurt) including stock price, stock chart, company news, key statistics, fundamentals and company profile. UR3 is the third generation UR robot called CB3. The E-series is the 4th generation. Biggest changes is that you have no Force Sensor, less Repeatability. UR3 | Complete United Rentals Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Price-To-Earnings vs Fair Ratio. Analyst Forecast. Share Price vs Fair Value. What is the Fair Price of UR3 when looking at its future cash flows? For this. Demark universal robot hotsale UR3 is good price. 3kg payload. We provide the most suitable collaborative robot to customer all over the world. An in-person, no-cost demo can also be arranged. We will deliver a solution and quote that best suits your business needs. I'm looking forward to learning. Back to Catalog · RWUR3. Zoom image. Michi Bomber. RWUR3. NOT AVAILABLE. Regular price $3, USD. Unit price. Learn how cost-effective, secure and flexible collaborative robots - or cobots - are making automation easier than ever for businesses of all sizes. UR3 · Product List · JAKA Zu3 cobot 3kg payload collaborative robot similar with UR3 cobot · universal robot UR3 3KG payload in good price · AUBO-I5 collaborative. If you have any questions, please contact us,WhatsApp:+86 ,[email protected] ignore the shipping cost displayed on the page. Please. Find the latest United Rentals Inc (haupa-instrument.ru) stock quote, history, news and other vital information to help you with your stock trading and investing. UR+ Fancort Dispense Kit (Universal Robots DIspensing Kit). Regular price $2, / • UR3, UR3e • UR5, UR5e • UR10, UR10e • UR16, UR16e. Software Version. UR3 Robot. price from: Not specified. I want to buy. Supplier information. RAR The UR3 robot is Universal Robots' smallest collaborative table-top robot. United Rentals Stock forecast & analyst price target predictions based on 12 analysts offering months price targets for UR3 in the last 3 months.