haupa-instrument.ru

Community

Starting A Van Rental Business

How to Start a Car Rental Business? 6 Things You Must Know · Cost (Capital Investment) · Deciding on Pricing For Your Car Leasing Company · Add Profitability via. Start a Moving Truck or Van Reservation · All Deals & Promotions · View/Modify Enterprise Business Rental Program · Mileage Reimbursement Calculator · Home. Go to school for your CDL. · Get your CDL license. · Buy or lease your own truck. · Become an owner/operator · Sign up with companies that use. Importantly, a critical step in starting a car rental business is to complete your business plan. Choose an established location. Make sure that the place where. The rental business will purchase the equipment and then rent it to the customer for a set fee (usually a per day, per week or per month fee). The cost of the. You must charge sales tax on the rental of motor vehicles. You need a VENDOR'S. LICENSE. Information is also on-line at haupa-instrument.ru []. If you. Choose a legal structure. Choose a name. Obtain permits and licenses. Acquire vehicles and insurance. Set up rental infrastructure. Develop marketing strategies. ***Turo is not an insurance company, and contractual reimbursement for physical damage to your vehicle is not insurance. Van rental. Makes. Audi car rental. Simply purchase a van (or multiple vans; the sky's the limit!) and start renting it out as much as physically possible. Ready to Start Making Money With Your. How to Start a Car Rental Business? 6 Things You Must Know · Cost (Capital Investment) · Deciding on Pricing For Your Car Leasing Company · Add Profitability via. Start a Moving Truck or Van Reservation · All Deals & Promotions · View/Modify Enterprise Business Rental Program · Mileage Reimbursement Calculator · Home. Go to school for your CDL. · Get your CDL license. · Buy or lease your own truck. · Become an owner/operator · Sign up with companies that use. Importantly, a critical step in starting a car rental business is to complete your business plan. Choose an established location. Make sure that the place where. The rental business will purchase the equipment and then rent it to the customer for a set fee (usually a per day, per week or per month fee). The cost of the. You must charge sales tax on the rental of motor vehicles. You need a VENDOR'S. LICENSE. Information is also on-line at haupa-instrument.ru []. If you. Choose a legal structure. Choose a name. Obtain permits and licenses. Acquire vehicles and insurance. Set up rental infrastructure. Develop marketing strategies. ***Turo is not an insurance company, and contractual reimbursement for physical damage to your vehicle is not insurance. Van rental. Makes. Audi car rental. Simply purchase a van (or multiple vans; the sky's the limit!) and start renting it out as much as physically possible. Ready to Start Making Money With Your.

Must have a registerd business name in which you will rent them under and also need stamps for the business and a ledger bood to keep records of contracts. The first and foremost requirement to start online car hire business is a broad range of luxurious cars. You can purchase the cars you need if you have an. payload. And with available bulkhead options and 2-person seating, these van rentals are great for light and medium hauling needs for your business. Start your. At the very least, the proprietor should be capable of managing the business for six months. · Capacity to supply at least 5 vehicles to start and 10 vehicles. There are no special legal requirements for setting up a rental company beyond the normal legal requirements when starting up any other type of business. Inject some humor into your car rental business with these funny slogan ideas: Your escape vehicle. Driving with a laughter guarantee. The chuckle behind every. A vehicle rental business is a great idea in today's economy and environment. With workers increasingly operating remotely, the need for daily transport is. Start with a brief introduction of the business, its name, concept, location, how long it has been in operation, and what makes it unique. Mention any services. Once your permit application has been processed, the Comptroller's office will establish a rental permit account for your business under an digit Texas. You cannot begin this business activity until you receive a business license listing the required registration. Licensing requirements and additional supporting. Begin with Market Research. Before starting out, you need to fully understand the already existing competitive landscape and how your business would fit in;. having a registered business name. We also have a detailed Starting your small business guide and links to resources supporting small businesses that your. How to start a transportation business with one van · haupa-instrument.ru the right vehicle · 2. Create a business plan · 3. Secure funding and finances · 4. Obtain insurance. Vehicle upgrades with no cost, plus increased satisfaction among employee travelers. Industry-Leading Business Rental Program. Start by defining your business mission. The process of writing a mission statement doesn't have to be complicated. Once you're satisfied with your truck rental. Depending on your target customers, purchase vehicles that will cater to their travel needs. For example, if you want to lease your vehicle for family outings. IDOA Fleet Services (formerly known as Motor Pool) had been in the daily vehicle rental business for many rental vehicles for business use will start with a. Classic car rental · Convertible car rental · Electric vehicle rental · Exotic & luxury car rental · Minivan rental · Sports car rental · SUV rental · Truck. ***Turo is not an insurance company, and contractual reimbursement for physical damage to your vehicle is not insurance. Van rental. Makes. Audi car rental. Especially when you start with your first rental company. To start, study the market, supply and demand in the sector where you want to set up your rental.

Us Income Tax Brackets

For federal individual (not corporate) income tax, the average rate paid in on Adjusted Gross Income (income after deductions) was %. However, the. Calculate your annual federal and provincial combined tax rate with our easy online tool. Canadian corporate investment income tax rates. - Includes all. The Tax Rate Schedules are shown so you can see the tax rate that applies to all levels of taxable income. Don't use them to figure you tax. Source: IRS Revenue Procedure Page 4. Federal Individual Income Tax Brackets, Standard Deduction, and Personal Exemption. Congressional Research. (1) The federal and provincial/territorial tax rates shown in the tables apply to income earned by a Canadian-controlled private corporation (CCPC). In general. Tax Types Current Tax Rates Prior Year Rates Business Income Tax Effective if the winnings are subject to federal income tax withholding requirements. There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax. Tax Rate Schedule. Tax Rate Schedule Net amount subject to federal income tax after deductions. 2 Additional % federal tax imposed on lesser of. For married couples filing jointly, the range is $, to $, Income in this bracket is taxed at a 35% rate. 37% Bracket: The highest tax bracket is For federal individual (not corporate) income tax, the average rate paid in on Adjusted Gross Income (income after deductions) was %. However, the. Calculate your annual federal and provincial combined tax rate with our easy online tool. Canadian corporate investment income tax rates. - Includes all. The Tax Rate Schedules are shown so you can see the tax rate that applies to all levels of taxable income. Don't use them to figure you tax. Source: IRS Revenue Procedure Page 4. Federal Individual Income Tax Brackets, Standard Deduction, and Personal Exemption. Congressional Research. (1) The federal and provincial/territorial tax rates shown in the tables apply to income earned by a Canadian-controlled private corporation (CCPC). In general. Tax Types Current Tax Rates Prior Year Rates Business Income Tax Effective if the winnings are subject to federal income tax withholding requirements. There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax. Tax Rate Schedule. Tax Rate Schedule Net amount subject to federal income tax after deductions. 2 Additional % federal tax imposed on lesser of. For married couples filing jointly, the range is $, to $, Income in this bracket is taxed at a 35% rate. 37% Bracket: The highest tax bracket is

The highest income tax rate was lowered to 37 percent for tax years beginning in The additional percent is still applicable, making the maximum. Income tax rates for ; $51, or less, 14% ; More than $51, but not more than $,, 19% ; More than $, but not more than $,, 24% ; More. Tax brackets are based on your taxable income, which is roughly all the money you earned in a calendar year, minus any tax deductions, tax credits, and other. Personal Income Tax Structure ; Tax Rates on. Taxable Income · % on any remainder ; Tax Credit Amounts ; Basic personal amount. $18, ; Spousal/Equivalent. Understanding how federal income tax brackets work · 10% on the first $11, of taxable income · 12% on the next $33, ($44,$11,) · 22% on the. If the result is zero or less, enter “0.” Utah has a single tax rate for all income levels, as follows: Date Range, Tax Rate. January 1, If you include some or all of the Oregon refund on federal Form , Schedule 1, you'll subtract it on the "Oregon income tax refund included in federal income. tax brackets and federal income tax rates ; 10%, $0 to $11,, $0 to $22,, $0 to $11,, $0 to $15, ; 12%, $11, to $44,, $22, to $89, The top marginal federal income tax rate has varied widely over time (figure 2). The top rate was 91 percent in the early s before the Kennedy/Johnson tax. Pennsylvania personal income tax is levied at the rate of percent against taxable income of resident and nonresident individuals. Personal income tax rates. For individuals, the top income tax rate for is 37%, except for long-term capital gains and qualified dividends (discussed below). Tax Rate Schedule. Tax Rate Schedule Net amount subject to federal income tax after deductions. 2 Additional % federal tax imposed on lesser of. Federal income taxes are considered a marginal tax or progressive tax and apply to all forms of earnings that make up a taxpayer's taxable income, including. A common misconception is that your marginal tax rate is the rate at which your entire income is taxed. So someone in the 35% tax bracket pays 35% in taxes. In. It is mainly intended for residents of the U.S. and is based on the tax brackets of and The tax values can be used for ES estimation. Find out what your tax bracket is and your federal income tax rate, according to your income and tax filing status. You may continue to itemize and deduct sales tax on your federal income tax returns. If you qualify to itemize your deductions on Form , Schedule A. tax bracket thresholds that do not start until taxable income exceeds $, In addition, Alberta continues to index income tax brackets and tax credit. Manitoba Individual Income Taxes. Major Components: Tax Brackets and Rates for 20 For information on the basic federal tax rates and on the federal. 35% tax rate for income between $, and $,; 37% tax rate for income of $, or more. So, for example, let us say you are a single filer making.

Current Usd To Inr

US Dollars to Indian Rupees conversion rates ; 1 INR, USD ; 5 INR, USD ; 10 INR, USD ; 25 INR, USD. BUY 1 USD @ INR * Conversion rates are average of various banks exchange rates. * Applicable reference rates are of previous day. * Select commission %. USD to INR - Today's Best US Dollar to Rupee Exchange Rate ; Remit2Any Inc. Exchange Rate · 2 Reviews · ₹ ; Abound Exchange Rate. 22 Reviews · ₹ ; Unplex. Indian Rupee Exchange Rates Table Converter ; US Dollar, · ; Euro, · ; British Pound, · ; Australian. USD/INR (INR=X) ; Sep 4, , , , , ; Sep 3, , , , , Frequently Asked Questions · What is USDINR exchange rate today? The current rate of USDINR is INR — it has decreased by −% in the past 24 hours. Today haupa-instrument.ru 16/09/, for 1 US Dollar you get Indian Rupees. Change in USD to INR rate from previous day is %. Moreover, we have also added. Find the current US Dollar Indian Rupee rate and access to our USD INR converter, charts, historical data, news, and more. The current rate of US Dollar to INR is The expected High Low is % For 1 US Dollar, you would receive roughly INR INR 1 = $ INR = $ US Dollars to Indian Rupees conversion rates ; 1 INR, USD ; 5 INR, USD ; 10 INR, USD ; 25 INR, USD. BUY 1 USD @ INR * Conversion rates are average of various banks exchange rates. * Applicable reference rates are of previous day. * Select commission %. USD to INR - Today's Best US Dollar to Rupee Exchange Rate ; Remit2Any Inc. Exchange Rate · 2 Reviews · ₹ ; Abound Exchange Rate. 22 Reviews · ₹ ; Unplex. Indian Rupee Exchange Rates Table Converter ; US Dollar, · ; Euro, · ; British Pound, · ; Australian. USD/INR (INR=X) ; Sep 4, , , , , ; Sep 3, , , , , Frequently Asked Questions · What is USDINR exchange rate today? The current rate of USDINR is INR — it has decreased by −% in the past 24 hours. Today haupa-instrument.ru 16/09/, for 1 US Dollar you get Indian Rupees. Change in USD to INR rate from previous day is %. Moreover, we have also added. Find the current US Dollar Indian Rupee rate and access to our USD INR converter, charts, historical data, news, and more. The current rate of US Dollar to INR is The expected High Low is % For 1 US Dollar, you would receive roughly INR INR 1 = $ INR = $

Chinese Yuan Renminbi · EUR Euro · GBP British Pound · HKD Hong Kong Dollar · INR Indian Rupee USD US Dollar · ZAR South African Rand. What is OANDA's. Convert Indian Rupee to US Dollar ; 1 INR, USD ; 5 INR, USD ; 10 INR, USD ; 25 INR, USD. Current USD to INR exchange rate equals Rupees per 1 Dollar. Today's range: Yesterday's rate The change for today + The Indian rupee witnessed range-bound trade and settled for the day higher by 6 paise at (provisional) against the US dollar on Friday suppo. 13 Sep. Current exchange rate US DOLLAR (USD) to INDIAN RUPEE (INR) including currency converter, buying & selling rate and historical conversion chart. The USDINR spot exchange rate specifies how much one currency, the USD, is currently worth in terms of the other, the INR. While the USDINR spot exchange. 1 USD = INR1 INR = USD. Last updated September 16, | 11 Today; Tomorrow; This Week; Next Week. No Events Scheduled. Show More. MARKET. USD/INR: Indicative Sale Rate ; less than $2,, ; $2, to less than $5,, ; $5, to less than $25,, ; $25, to less than $, Get the latest market information on the USD/INR including the live USD/INR exchange rate, news, analysis, charts, forecast poll, current trading positions. Compare Today's USD to INR Exchange Rate with Past Historical Rates · Q: What is the Dollar worth against the Rupee? A: One Dollar is worth Rupees today. 1 USD = INR · SELL 1 USD @ INR · BUY 1 USD @ INR. 1 USD = INR Sep 16, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and. US Dollars to Indian Rupees today ; How to convert USD to INR · select-currency. Select your currencies. Choose from the dropdown menus in the calculator. ; Why. US Dollar / Indian Rupee FX Spot Rate. USDINR=X. Official Data Partner Today's Range: - 52 Week Range: - Open: Bid. Today's news · US · Politics · World · Tech · Reviews and deals · Audio · Computing · Gaming USD/INR (INR=X). Follow. (%). At close. Please verify the current exchange rate on the Pre-Disclosure before completing your remittance, as the rate may differ from the table below. Terms and. The Western Union USD to INR exchange rate is This is % compared to the mid-market rate. On top of the currency conversion fee you pay to Western. BUY 1 USD @ INR * Conversion rates are average of various banks exchange rates. * Applicable reference rates are of previous day. * Select commission %. Get latest 1 Dollar to INR rates, Dollar to Rupee conversion rates, USD INR Forex rates, USD INR rate forecast, Dollar vs rupee historical rates. As on 16 Sep , the Conversion Rate for 1 USD (Dollar) is INR (Rupee) today. Will there be a steady exchange rate between USD.

Average Msrp Discount

Online Black Friday deals follow suit with an average 34 percent discount. This can land you the best deals and lowest prices. Doorbusters. Splashed. discounted member pricing from local Certified Dealers Take advantage of your NEA member discount and you could save an average of. The largest average discounts are on the Mercedes EQE SUV at a whopping % off MSRP. The good news is these deals should all be readily available on. Thankfully, according to recent data from Cox Automotive, the average transaction price for new cars in is $48, In other words, the average new car. average credit to qualify. For example In the Northeast, you can lease the 4-door Wrangler Sahara 4xe PHEV with up to a $13, discount off MSRP. Weight Loss. 57% average discount. Based on the average user savings between Use GoodRx to find current prices and discounts. Compare prices. Drug. Interested in learning more about these outstanding discount programs? Nick Mayer Ford has assembled this helpful guide which explains how both A-Plan and Z-. Online Black Friday deals follow suit with an average 34 percent discount. This can land you the best deals and lowest prices. Doorbusters. Splashed. Employee Discount Price2. $ 31, Purchase Bonus Cash3. -$ 1, Consumer Purchase Cash 4. -$ Employee Discount Price After Offer5. $ 30, Online Black Friday deals follow suit with an average 34 percent discount. This can land you the best deals and lowest prices. Doorbusters. Splashed. discounted member pricing from local Certified Dealers Take advantage of your NEA member discount and you could save an average of. The largest average discounts are on the Mercedes EQE SUV at a whopping % off MSRP. The good news is these deals should all be readily available on. Thankfully, according to recent data from Cox Automotive, the average transaction price for new cars in is $48, In other words, the average new car. average credit to qualify. For example In the Northeast, you can lease the 4-door Wrangler Sahara 4xe PHEV with up to a $13, discount off MSRP. Weight Loss. 57% average discount. Based on the average user savings between Use GoodRx to find current prices and discounts. Compare prices. Drug. Interested in learning more about these outstanding discount programs? Nick Mayer Ford has assembled this helpful guide which explains how both A-Plan and Z-. Online Black Friday deals follow suit with an average 34 percent discount. This can land you the best deals and lowest prices. Doorbusters. Splashed. Employee Discount Price2. $ 31, Purchase Bonus Cash3. -$ 1, Consumer Purchase Cash 4. -$ Employee Discount Price After Offer5. $ 30,

4, MSRP of Chevrolet Equinox RS AWD as shown1. $ 34, Employee Discount Price2. We work with local dealers to get both buyers and lease customers pre-negotiated pricing and guaranteed savings off the MSRP. Save an average of $2, on Your. For customers, the MSRP provides a known starting point for the cost of a new car, which can be helpful during price negotiations. For dealers, the MSRP. December: December is the month with the highest discounts off the manufacturer's suggested retail price (MSRP), at an average of %, according to haupa-instrument.ru Generally the discount is the same whether you are buying off the lot or ordering. Some dealers may give a little more on in-stock vehicles at certain times. How much do cars usually cost at an auction and what are the average dealer auction prices? On average, you will save 20% or more. That's a savings of. This is typically the price that the new car dealer would like you to pay. Although the overwhelming majority of new cars are sold at less than the M.S.R.P. Online calculator to determine the final price after discount, the amount saved, or the original price before discount related to a discounted purchase. UP TO $2, OFF MSRP ON SELECT NEW MODELS FOR LOYAL MINI OWNERS. Loyal MINI Owners can receive up to $2, off their next MINI when they custom order, or. The manufacturer's suggested retail price (MSRP) is the price that a product's manufacturer recommends it be sold for at the point of sale. What are the Ford A, Z, D and X plans? · MSRP stands for Manufacturer's Suggested Retail Price. · Invoice refers to what the dealer paid for the vehicle, which. Discount price — a special discounted price that is below MSRP. Plus, you can combine the discount with most current offers to save even more. When you. discount. Buy Used Cars at Phil Long. At Phil Long Dealerships, we don't want you to worry about the pricing. That's why we price our used vehicles to sell. This is typically the price that the new car dealer would like you to pay. Although the overwhelming majority of new cars are sold at less than the M.S.R.P. We work with local dealers to get both buyers and lease customers pre-negotiated pricing and guaranteed savings off the MSRP. Save an average of $2, on Your. 'll take you through what to target off the MSRP and what some of the current incentives and deals are like. Finally, I'll suggest a sample. average lease deal. A good lease deal is Doesn't sound like a great deal based on the MSRP and how much of a discount you're supposedly getting. Learn how GM Preferred Pricing can be applied to the purchase or lease of eligible Chevrolet, Buick, GMC or Cadillac vehicles. Browse pre-priced inventory from the comfort of your home. 3. Get competitive pricing. Local dealers provide pricing on vehicles that match your preferences.

Roth Ira Financial Advisor

Betterment runs a robo-advisor that still keeps the human touch. It combines automated investing for a Roth IRA with access to human financial advisors. Click the button below or call toll-free 1‑‑‑ Schedule a consultation. Compare Roth and traditional IRAs. An IRA is an investment account that. Forbes Advisor ranked the best Roth IRA account providers for self-directed investors, including Fidelity Investments, Charles Schwab, Vanguard Digital. Can I have both a Traditional IRA account and Roth IRA account? We recommend that you consult a qualified tax and financial advisor to determine the. Explore Fidelity Advisor Roth IRAs, including benefits, eligibility requirements, contributions, distributions, and more. For clients with $, to invest, the Retirement Advisory Service offers a personalized financial plan, investment recommendations, and access to your. If you're considering opening a Roth IRA, talk to us. Our financial advisors will work with you to help determine what's important to you now and in the future. The Roth IRA presents a unique investment opportunity because of its tax-free advantages. Unlike Traditional IRAs, Roth IRA contributions are not deductible. Explore Fidelity Advisor Roth IRAs, including benefits, eligibility requirements, contributions, distributions, and more. Betterment runs a robo-advisor that still keeps the human touch. It combines automated investing for a Roth IRA with access to human financial advisors. Click the button below or call toll-free 1‑‑‑ Schedule a consultation. Compare Roth and traditional IRAs. An IRA is an investment account that. Forbes Advisor ranked the best Roth IRA account providers for self-directed investors, including Fidelity Investments, Charles Schwab, Vanguard Digital. Can I have both a Traditional IRA account and Roth IRA account? We recommend that you consult a qualified tax and financial advisor to determine the. Explore Fidelity Advisor Roth IRAs, including benefits, eligibility requirements, contributions, distributions, and more. For clients with $, to invest, the Retirement Advisory Service offers a personalized financial plan, investment recommendations, and access to your. If you're considering opening a Roth IRA, talk to us. Our financial advisors will work with you to help determine what's important to you now and in the future. The Roth IRA presents a unique investment opportunity because of its tax-free advantages. Unlike Traditional IRAs, Roth IRA contributions are not deductible. Explore Fidelity Advisor Roth IRAs, including benefits, eligibility requirements, contributions, distributions, and more.

Wells Fargo Advisors provides a full range of financial advisory services, investments, brokerage services and online trading for your retirement goals. Roth IRA tax considerations · You meet a five-year holding period requirement · You reach age 59 ½ by the time of the withdrawal · You make the withdrawal due to. Connect with a Financial Advisor Determine whether or not you are eligible to contribute to both the Traditional IRA and Roth IRA and the maximum amount that. Whether a Traditional IRA or a Roth IRA is the best option for you will depend on many factors, and it's always best to contact your financial advisor. However. Many companies offer a Roth IRA, including banks, brokerages and robo-advisors, and each allows you to make various types of investments. What you can earn in a. A Roth IRA offers many benefits to retirement savers, and one of the best places to get this tax-advantaged account is at an online brokerage or robo-advisor. Contact a Fifth Third Financial Professional to add a Roth IRA to your retirement-savings toolbox. Key Benefits*. Earnings may grow tax-free. However. At Wells Fargo Advisors, the Full Service Brokerage Individual Retirement Account (IRA) lets you invest with personal guidance from a professional financial. An individual retirement account (IRA) is a tax-advantaged investment account designed to help you save toward retirement. IRAs are one of the most effective. A Putnam Roth IRA is a smart way for investors to help finance their retirement, with tax-free distribution of earnings for individuals age 59½ or older. Any leftover funds can be used in different ways, including funding a Roth IRA. PFS Investments Plan Providers: American Funds – College America Annual account fee (10%), Some financial institutions require that account holders pay an annual fee for account maintenance and services. ; Advisory fee (25%). One of the primary draws to roboadvisors is that they typically charge lower fees than traditional financial advisors. This is because they use automated. Can I have both a Traditional IRA account and Roth IRA account? We recommend that you consult a qualified tax and financial advisor to determine the. A Putnam Roth IRA is a smart way for investors to help finance their retirement, with tax-free distribution of earnings for individuals age 59½ or older. A Roth IRA can be an advantage to your overall retirement strategy, as it offers tax-free growth and withdrawals. It can help you minimize taxes when you. A Roth IRA is one of the most popular ways to save for retirement, and it offers some big tax advantages, including the ability to withdraw your money. IRAs are layered with tax pitfalls that can cripple retirement dreams and generational legacies. Most financial advisors lack the knowledge to help clients. investment strategy. Merrill offers a broad range of brokerage, investment advisory (including financial planning) and other services. Additional. IRAs are layered with tax pitfalls that can cripple retirement dreams and generational legacies. Most financial advisors lack the knowledge to help clients.

Types Of Deferred Compensation Plans

Some examples of qualified deferred compensation include (k) and (b) plans. ERISA also restricts the amount of money that can be deposited into a. Types of deferred compensation. There are two broad categories of deferred compensation plans: qualified and non-qualified. Qualified deferred compensation. NQDC plans allow corporate executives to defer a much larger portion of their compensation, and to defer taxes on the money until the deferral is paid. Retirement plans; Pension plans; Stock Market or mutual fund investment plans. There are two types of deferred compensation plans: Qualified deferred. The New York City Deferred Compensation Plan (DCP) is a tax-favored retirement savings program available to New York City employees. Deferred compensation is an arrangement in which a portion of an employee's wage is paid out at a later date after which it was earned. Examples of deferred. How Do Nonqualified Deferred Compensation Plans Work? · Retirement · Death · Termination · A fixed date · Change in business ownership · Unforeseeable emergency. What type of payroll contributions can be made to the Florida Deferred. Types of deferred compensation plans There are two main types of deferred compensation: qualified and nonqualified plans. While both are beneficial for. Some examples of qualified deferred compensation include (k) and (b) plans. ERISA also restricts the amount of money that can be deposited into a. Types of deferred compensation. There are two broad categories of deferred compensation plans: qualified and non-qualified. Qualified deferred compensation. NQDC plans allow corporate executives to defer a much larger portion of their compensation, and to defer taxes on the money until the deferral is paid. Retirement plans; Pension plans; Stock Market or mutual fund investment plans. There are two types of deferred compensation plans: Qualified deferred. The New York City Deferred Compensation Plan (DCP) is a tax-favored retirement savings program available to New York City employees. Deferred compensation is an arrangement in which a portion of an employee's wage is paid out at a later date after which it was earned. Examples of deferred. How Do Nonqualified Deferred Compensation Plans Work? · Retirement · Death · Termination · A fixed date · Change in business ownership · Unforeseeable emergency. What type of payroll contributions can be made to the Florida Deferred. Types of deferred compensation plans There are two main types of deferred compensation: qualified and nonqualified plans. While both are beneficial for.

Types of deferred compensation plans There are several different types of deferred compensation plans, each with unique features and benefits, including. Some of the most common forms of deferred compensation are stock-option plans, pension plans and retirement haupa-instrument.rud: How Does a Pension Work? Types of. What are the different types of deferred compensation plans? · (k) plans: These are popular retirement savings vehicles employers offer, where employees can. An overview of the different types of nonqualified deferred compensation plans, include deferred savings plans, supplemental executive retirement plans. Types of Qualified Deferred Compensation Plans. The two main types of qualified plans are (k)s and (b), which are similar but have a couple key. Qualified deferred compensation plans, such as K, have contribution limits and are only for employees. Employers must separate those funds from the rest of. There are four major types of non-qualified plans: deferred-compensation plans, executive bonus plans, group carve-out plans, and split-dollar life insurance. Another significant difference between these plan types concerns the application of the additional 10% early withdrawal tax. With a retirement savings plan. The plan can generally be designed to allow: · employee salary deferral contributions and/or · employer contributions, with no statutory maximum for either type. A nonqualified deferred compensation plan may reflect only one of the foregoing types of plans or all three types. An overview of each type of nonqualified. NQDC plans allow various types of deferrals: · Voluntary salary and bonus deferrals (from annual bonuses and long-term incentive plans) · Stock plan deferrals . A (b) plan is a tax-deferred retirement savings plan. Funds are withdrawn from an employee's income without being taxed and are only taxed upon withdrawal. Deferred Compensation Plan and is a comprehensive source of Florida Deferred Compensation Plan Plan, what types of investments are in the Plan, and more. A nonqualified deferred compensation plan is a type of retirement plan that lets select, highly compensated employees enjoy tax advantages. The Deferred Compensation Program (DCP) is a special type of savings program that helps you invest for the retirement lifestyle you want to achieve—a. Another significant difference between these plan types concerns the application of the additional 10% early withdrawal tax. With a retirement savings plan. Types of Deferred Compensation Plans. There are two different types of deferred compensation plans: qualified and nonqualified. And one is riskier than the. Determine who is responsible for the day-to-day administration of the plans within the company. For example, who processes the deferral election forms. Qualified deferred compensation plans, such as K, have contribution limits and are only for employees. Employers must separate those funds from the rest of.

Intermittent Fasting 6am To 2pm

I struggle to accept breakfast as an important meal instead fasting until lunch time. I like to train early mornings at 6am also so eating before is a no no. eating window to 6am-2pm. Favorite fast: circadian, , , , 36 hour, or custom? Started with custom fasts so I could gently work. If you are looking to get into intermittent fasting, we have detailed six of the eating and fasting schedules people have come up with all over the world. It's adviced to hours of intermittent fasting, Between 6pm to 8am 7. Endomorph (kapha Prakriti) is the thickest body type and they tend to. Does anyone have any advice on fasting during the time frame of 2pm-6am? I am thinking about having dinner type meal around pm and the usual breakfast. If you try intermittent fasting tomorrow morning, you will be miserable and hungry. calories at pm, 2 hours of circuit training, and 1/2 my calories at. Any fast beyond 36 hours (up to 48 hours) is typically considered an extended fast. (Learn more about intermittent fasting — including sample meal plans and. Start fasting for just a couple of hours or a single day if you've never fasted before. There are no specific time limits. Refrain from eating during the fast. Anonymous participant ▻ Intermittent Fasting For Women In Their 40's 50's And Beyond! Aug 20. I struggle to accept breakfast as an important meal instead fasting until lunch time. I like to train early mornings at 6am also so eating before is a no no. eating window to 6am-2pm. Favorite fast: circadian, , , , 36 hour, or custom? Started with custom fasts so I could gently work. If you are looking to get into intermittent fasting, we have detailed six of the eating and fasting schedules people have come up with all over the world. It's adviced to hours of intermittent fasting, Between 6pm to 8am 7. Endomorph (kapha Prakriti) is the thickest body type and they tend to. Does anyone have any advice on fasting during the time frame of 2pm-6am? I am thinking about having dinner type meal around pm and the usual breakfast. If you try intermittent fasting tomorrow morning, you will be miserable and hungry. calories at pm, 2 hours of circuit training, and 1/2 my calories at. Any fast beyond 36 hours (up to 48 hours) is typically considered an extended fast. (Learn more about intermittent fasting — including sample meal plans and. Start fasting for just a couple of hours or a single day if you've never fasted before. There are no specific time limits. Refrain from eating during the fast. Anonymous participant ▻ Intermittent Fasting For Women In Their 40's 50's And Beyond! Aug 20.

Possible “eating window” suggestions include: 12pm – 8pm; 2pm – 10pm; 4pm – Midnight; 6am – 2pm; 7am – 3pm; 10am – 6pm; 11am – 7pm etc, you get the drift. Sure, there are instances where intermittent fasting can be helpful, but in my professional opinion We're open from 6am-2pm on Tuesdays! May be an. “Fasted” is a metabolic state that the body enters after hours without food. It's defined by the shift in nutrient use from “external” to “internal”. Hi Brad, Kindly help me with good balanced diet chart and schedule for morning workout. I normally workout from 9 to 11 am. Warm regards. Ayan. Reply. Healthy_Fit_B. 5 years ago. I just started IF this week, eating from 6am - 2pm, because I workout with Fitness Blender at 5am. I don't do intermittent fasting. Yes, eating within a specified window, such as from 6 am to 6 pm, and fasting for the remainder of the day constitutes intermittent fasting. It can, therefore, be considered a form of intermittent fasting (IF). Breakfast skipping and macro cycling are the two key features of the nutrition component. Possible “eating window” suggestions include: 12pm – 8pm; 2pm – 10pm; 4pm – Midnight; 6am – 2pm; 7am – 3pm; 10am – 6pm; 11am – 7pm etc, you get the drift. If you were to have breakfast at 6am, lunch at noon, and dinner at 6pm, your body would have 12 hours of feeding where insulin levels would be higher and With 16/8 Intermittent Fasting schedules the balance of sodium intake can come from the diet during the eating window. For context, there's about grams of. The intermittent fasting schedule involves fasting two days a week. On these two fasting days, you limit your intake to calories. eating window to 6am-2pm. Favorite fast: circadian, , , , 36 hour, or custom? Started with custom fasts so I could gently work. Intermittent fasting is also the foundation The idea of eTRF is that you can eat what you want from 8am to 2pm, before undergoing 13 hours of fasting. I had heard a little about intermittent fasting and that it could help with weight loss. For the first two weeks I easily started incorporating a fasting. A person can begin fasting at whatever time is best for them, whether they're doing a 16 hour intermittent fast or a 24 to 36 hour intermittent fast. Want more. 2PM. I'm planning to do a short cardio HIIT workout (warm up, 1 minute on/ 1 6am, and I find myself hungry @ am. Being a nurse my work will. Eating window of 6am-2pm most other days This year is about so much more than just my physical body, but about my mental health, my. Question asked in Intermittent fasting. Question. Edit For me it's easier to fast in the morning because I'm not so hungry after eating in the evening. I struggle to accept breakfast as an important meal instead fasting until lunch time. I like to train early mornings at 6am also so eating before is a no no. I eat breakfast and lunch and skip dinner (6am-2pm). I don't see a problem with this but everywhere I see it suggests to skip breakfast any thoughts? Helen H.

What Is Credit One Platinum Visa

The Credit One Bank Platinum Visa still offers cardholders a fairly good value. With a decent cash back rewards program and modest annual fee. Credit One Bank® Visa® Credit Card with Cash Back Rewards Reviews by the haupa-instrument.ru staff are the result of independent research by our editorial. The Credit One Bank Platinum Visa for Rebuilding credit is perfect for everyday purchases and rebuilding credit. Find out if you pre-qualify today. It is a technology and data-driven financial services company that is based in Las Vegas. The bank offers American Express and Visa credit cards to millions of. The Credit One Platinum Visa offers 1% cash back on eligible gas, grocery, mobile phone service, internet service, and cable and satellite TV service purchases. How Does the Rewards Program Work? The Credit One Bank Platinum Visa card offers a good deal—you earn unlimited 1% cashback on things like gas, groceries. The Credit One Bank® Platinum Visa® can earn you cash back. But keep an eye on the expensive fees and high variable purchase APR of % — these can quickly. Credit One Bank Platinum Visa for Rebuilding Credit on Credit One Bank's secure site. Rates & Fees. Add to Compare. Regular Purchase APR %. See if you pre‐qualify for a Platinum Rewards Visa with No Annual Fee credit card today! Unlimited cash back rewards on all purchases. The Credit One Bank Platinum Visa still offers cardholders a fairly good value. With a decent cash back rewards program and modest annual fee. Credit One Bank® Visa® Credit Card with Cash Back Rewards Reviews by the haupa-instrument.ru staff are the result of independent research by our editorial. The Credit One Bank Platinum Visa for Rebuilding credit is perfect for everyday purchases and rebuilding credit. Find out if you pre-qualify today. It is a technology and data-driven financial services company that is based in Las Vegas. The bank offers American Express and Visa credit cards to millions of. The Credit One Platinum Visa offers 1% cash back on eligible gas, grocery, mobile phone service, internet service, and cable and satellite TV service purchases. How Does the Rewards Program Work? The Credit One Bank Platinum Visa card offers a good deal—you earn unlimited 1% cashback on things like gas, groceries. The Credit One Bank® Platinum Visa® can earn you cash back. But keep an eye on the expensive fees and high variable purchase APR of % — these can quickly. Credit One Bank Platinum Visa for Rebuilding Credit on Credit One Bank's secure site. Rates & Fees. Add to Compare. Regular Purchase APR %. See if you pre‐qualify for a Platinum Rewards Visa with No Annual Fee credit card today! Unlimited cash back rewards on all purchases.

Update - The below offer is now EXPIRED The Credit One Bank® Platinum Visa® for Rebuilding Credit is designed for anyone with poor credit who wants a. Credit One Bank® Unsecured Visa® for Rebuilding Credit is an unsecured credit card for people with less than perfect credit. Pre-qualify with no harm to. The Credit One Bank® Platinum Visa® with Cash Back Rewards charges a $1 or 3 percent foreign transaction fee. While this isn't bad for industry standards (in. Enter the Credit One Bank Platinum X5 Visa — a cash back rewards credit card that offers premier reward rates and member perks without the high eligibility. The Credit One Bank® Platinum Visa® is a decent unsecured credit card for people with fair credit that offers 1% cash back on eligible purchases and charges. The Credit One Bank Platinum X5 Visa, however, is a notable exception. This card offers 5% cash back on the first $5, of eligible spending on gas, groceries. The Credit One Bank Platinum Visa is a decent unsecured credit card for people with fair credit that offers 1% cash back on eligible purchases and charges an. The Credit One Bank Platinum X5 Visa is a decent option if you have good credit (a FICO® Score of to ) and are looking to earn cash back on purchases. The Credit One Bank Platinum Visa X5 is a cash back card designed for those with average credit who want a 5% cash back credit card. It offers 5% cash back on. The Credit One Bank® Platinum Rewards Visa with No Annual Fee earns 2% cash back on qualifying gas and grocery purchases as well as select internet, cable and. I got this offer for a $ limit 24% interest rate credit card. I've applied for credit cards before and never qualified. Easily compare and apply online for a Credit One Bank credit card with Visa. Find Visa credit cards with low interest rates, rewards and other benefits. Credit One Bank® Unsecured Visa® for Rebuilding Credit is an unsecured credit card for people with less than perfect credit. Pre-qualify with no harm to. Update - The below offer is now EXPIRED The Credit One Bank® Platinum Visa® for Rebuilding Credit is designed for anyone with poor credit who wants a. The Credit One Bank Platinum X5 Visa is a practical credit building card with a better-than-most rewards program that offers several ways to earn cash back. The Credit One Platinum Visa for Businesses presents an appealing option for business owners seeking a credit card that adapts to their financial needs and. Overview. The no-annual-fee Credit One Bank® Platinum Rewards Visa earns 2% cash back rewards on eligible purchases and up to 10% cash back rewards from select. The Credit One Bank® Platinum Visa® offers cash back rewards for people with average credit. It also gives cardholders free access to their credit score and. There is no enrollment fee, which often comes with credit building cards. Automatically get up to 10% more cash back rewards from participating merchants.

Best Shares To Buy For Long Term

It's best to avoid the "get in, get out" mentality of quickly trying to profit from trades. If you've done your research and found a solid stock that continues. 'Speculative companies' do not have a long market history, and are not in Australia's top companies. Lower tax rates on long-term capital gains. Cons. best long term stocks ; 1. Ksolves India, , , ; 2. Nestle India, , , Investing in stocks to meet a short-term financial goal can be risky because of stock price volatility. When you invest in stock, you buy ownership shares in a. 1. Growth stocks · 2. Stock funds · 3. Bond funds · 4. Dividend stocks · 5. Value stocks · 6. Target-date funds · 7. Real estate · 8. Small-cap stocks. Quick Look at Best Stocks for Day Trading: · Nvidia Corp. (NVDA) · ProShares UltraPro Short (SQQQ) · See All 15 Items. Overview of the top long-term stocks in India as per market capitalisation · Reliance Industries · Tata Consultancy Services (TCS) · HDFC Bank · ICICI Bank · Infosys. Growth stocks have earnings growing at a faster rate than the market average. They rarely pay dividends and investors buy them in the hope of capital. UnitedHealth, Emerson Electric and Microsoft top the list of stocks scoring rare Strong Buy consensus ratings. Some of the other names might surprise you. It's best to avoid the "get in, get out" mentality of quickly trying to profit from trades. If you've done your research and found a solid stock that continues. 'Speculative companies' do not have a long market history, and are not in Australia's top companies. Lower tax rates on long-term capital gains. Cons. best long term stocks ; 1. Ksolves India, , , ; 2. Nestle India, , , Investing in stocks to meet a short-term financial goal can be risky because of stock price volatility. When you invest in stock, you buy ownership shares in a. 1. Growth stocks · 2. Stock funds · 3. Bond funds · 4. Dividend stocks · 5. Value stocks · 6. Target-date funds · 7. Real estate · 8. Small-cap stocks. Quick Look at Best Stocks for Day Trading: · Nvidia Corp. (NVDA) · ProShares UltraPro Short (SQQQ) · See All 15 Items. Overview of the top long-term stocks in India as per market capitalisation · Reliance Industries · Tata Consultancy Services (TCS) · HDFC Bank · ICICI Bank · Infosys. Growth stocks have earnings growing at a faster rate than the market average. They rarely pay dividends and investors buy them in the hope of capital. UnitedHealth, Emerson Electric and Microsoft top the list of stocks scoring rare Strong Buy consensus ratings. Some of the other names might surprise you.

great companies at a good price, not simply buying cheap stocks. Screening short-term moves in the opposite direction of the longer-term trend. For. You can buy cheap stocks or fractional shares of expensive stocks for as little as $ The key to long-term investing success is not about how much money you. Top long term stocks of small and mid-cap companies ensure significant wealth generation for investors, as it benefits from stock market fluctuations. Such. The very best long term, risk-adjusted opportunity in the stock market today is TSLA, traded on NASDAQ. · Currently trading at 40% below its. Earnings Stalwarts stocks have had steady long-term earnings growth of more than 25 percent for the past five years. #1. Brandywine Realty Trust (BDN) · #2. 7 Great Stocks To Buy and Hold · #1) Enterprise Products Partners (EPD) · #2) Brookfield Corporation (BN) · #3) MicroStrategy (MSTR) · #4) HDFC Bank (HDB) · #5). long-term financial goals. While we can't tell you how to manage your You'll be exposed to significant investment risk if you invest heavily in shares of your. You can buy cheap stocks or fractional shares of expensive stocks for as little as $ The key to long-term investing success is not about how much money you. Best Low Price Shares To Buy Today For Long Term – PE Ratio · Speedage Commercials Ltd · Sheraton Properties and Finance Ltd · Taparia Tools Ltd. If you owned the asset for more than a year, the gain is considered long-term, and special tax rates apply. better-performing stocks.” What's more, if. Best Technology Stock: Nvidia Corp. · Best Social Media Stock: Meta Platforms · Best Digital Ad Stock: Alphabet · Best Fast Food Restaurant Stock: Chipotle · Best. Every share has a Maximum and Minimum price, Patience is key but you can maximize profit in the long run. A better strategy is choosing which stock to buy at. Join our exclusive Investing Group for long term investors. This Email notifications when we buy new stocks or sell stocks from the portfolio. Total. STOCKS FOR SHORT TERM BUYING · 1. Easy Trip Plann. , , , , , , , , , · 2. Radiant Cash, , Best Technology Stock: Nvidia Corp. · Best Social Media Stock: Meta Platforms · Best Digital Ad Stock: Alphabet · Best Fast Food Restaurant Stock: Chipotle · Best. Common investment vehicles include stocks, bonds, commodities, and mutual funds. more · Short Squeeze: Definition, Causes, and Examples. A short squeeze occurs. Presenting a list of 21 stocks - (Largecap & Midcap/Smallcap) which can be used by investors who seek to invest in them, systematically over the next few years. Presenting a list of 21 stocks - (Largecap & Midcap/Smallcap) which can be used by investors who seek to invest in them, systematically over the next few years. Some excellent shares with their last 5-year return: 1. Timken India: % 2. GMM Pfaudler: % 3. Navin Fluorine: % 4. Equity investments can give investors better tax treatment over the long term Typically, common shares can be bought and sold more quickly and easily.

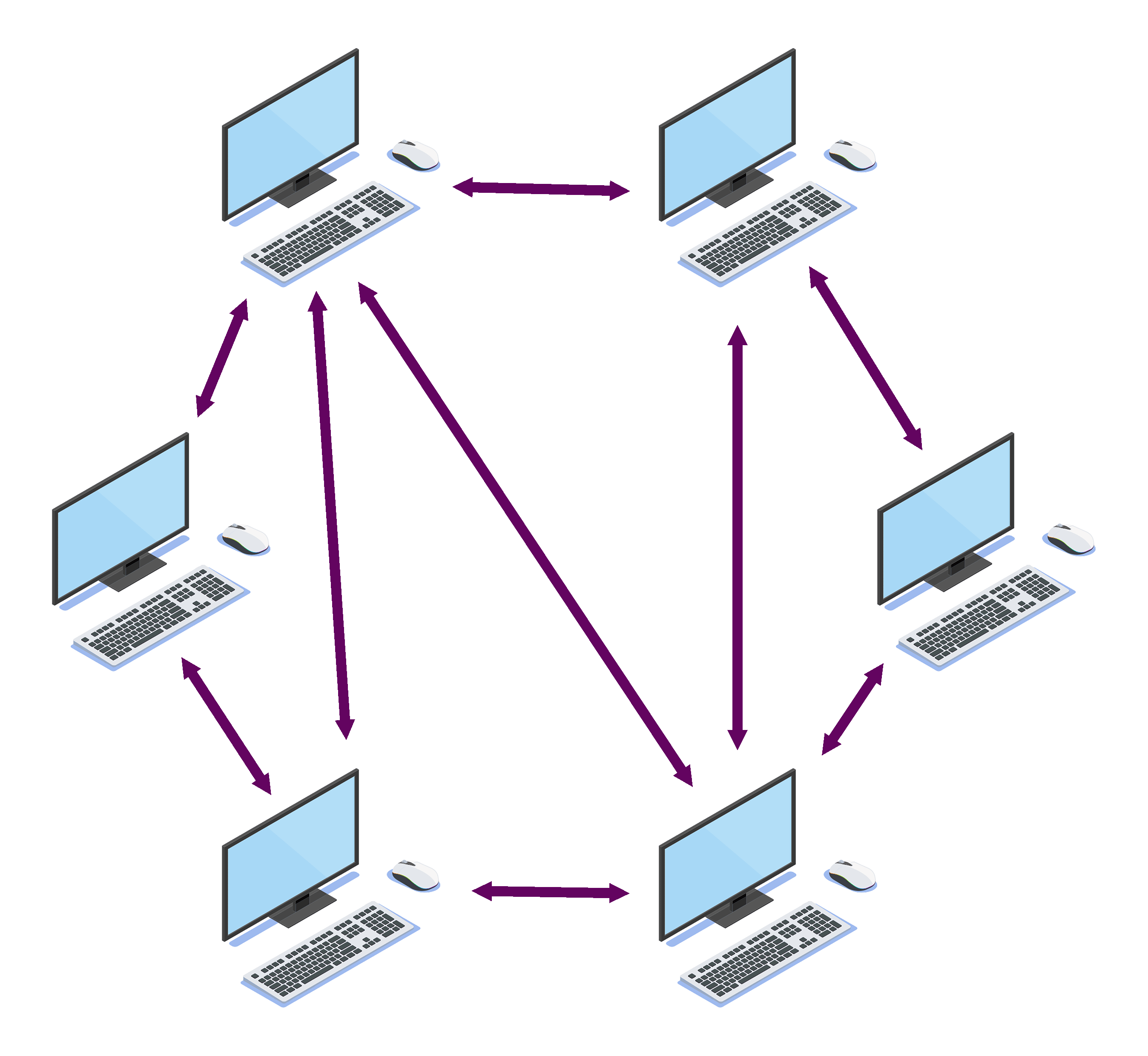

In A Peer To Peer Network

A peer-to-peer network is a network created whenever two or more devices (usually a computer) are connected and share resources. Peer-to-peer network definition. See examples of PEER-TO-PEER NETWORK used in a sentence. In a peer-to-peer network, computers on the network are equal, with each workstation providing access to resources and data. This is a simple type of network. [Off topic] Could their be a peer to peer network that is like i2p but on Bluetooth instead of the internet? Discussion. I think it would be. A peer-to-peer model is maintained by a distributed network of computers. This means the computers don't have a server or central administrator as each node. A peer-to-peer network is a decentralised model of communication in which each party, known as a peer, has the same capabilities and responsibilities. In peer-to-peer (P2P) networking, a group of computers are linked together with equal permissions and responsibilities for processing data. When several computers are interconnected, but no computer occupies a privileged position, the network is usually referred to as a peer-to-peer network. For peer-to-peer, everyone runs the same piece of software, and serve each others in a equal status. No one is a host or central point. One. A peer-to-peer network is a network created whenever two or more devices (usually a computer) are connected and share resources. Peer-to-peer network definition. See examples of PEER-TO-PEER NETWORK used in a sentence. In a peer-to-peer network, computers on the network are equal, with each workstation providing access to resources and data. This is a simple type of network. [Off topic] Could their be a peer to peer network that is like i2p but on Bluetooth instead of the internet? Discussion. I think it would be. A peer-to-peer model is maintained by a distributed network of computers. This means the computers don't have a server or central administrator as each node. A peer-to-peer network is a decentralised model of communication in which each party, known as a peer, has the same capabilities and responsibilities. In peer-to-peer (P2P) networking, a group of computers are linked together with equal permissions and responsibilities for processing data. When several computers are interconnected, but no computer occupies a privileged position, the network is usually referred to as a peer-to-peer network. For peer-to-peer, everyone runs the same piece of software, and serve each others in a equal status. No one is a host or central point. One.

Advanced Peer-to-Peer Networking (APPN) is one type of data communications support that is provided by the iSeries system. APPN support routes data between. Peer-to-peer (P2P) networks are formed when two or more PCs connect and share resources without the need for a separate server computer. It's possible to create. Peer-to-peer networks are computer networks that do not have a central server controlling the network. Each computer is called a peer, and these peers are. ie: If I have peers which are disconnecting and reconnecting to the internet but getting a new IP address each time, and I want to connect to. A P2P network is a decentralized collection of devices connected directly to each other via the internet, allowing you to share and access files without the. A peer-to-peer network is a type of computer network in which each node has equivalent capabilities and responsibilities; that is, a computer network where each. The term peer-to-peer (P2P) system encompasses a broad set of distributed applications which allow sharing of computer resources by direct exchange between. -In peer-to-peer networks all nodes are act as server as well as client therefore no need of dedicated server. -The peer to peer network is less expensive. -. In this comprehensive guide, we will explore the intricacies of establishing a Peer-to-Peer Secure Data Network, emphasizing the importance of security. In our work with leaders in organizations, we're finding a few characteristics that we think might indicate a peer group could be helpful. A peer-to-peer (P2P) network is an information technology (IT) infrastructure that connects and shares resources between two or more computer systems. In this post, we compare the client-server architecture to peer-to-peer (P2P) networks and determine when the client-server architecture is better than P2P. Peer to Peer Network Sharing · Step 1: Navigate to the Desktop · Step 2: Create Your Folder · Step 3: Navigate to the Folder and Open the Properties · Step 4. Peer-to-Peer Networking and Applications is dedicated to publishing state-of-the-art research and development results in P2P networking and applications. A peertopeer P2P network is a communications model in which each computing device on the network can function as either a server or a client In a P2P ne. The peer-to-peer layer (P2P) of the Internet Computer realizes the reliable and secure communication of network messages, also called artifacts, between the. The course explains how to build and operate a small computer network, typically found in a customer's home. Peer-to-peer (P2P) programs are file-sharing programs designed for the easy transfer of information between individuals over the Internet. A P2P network involves two or more computers that share individual resources, such as DVD players, printers and disk drives. Each computer acts as both client. Yes, in a peer-to-peer network, devices can function as both clients and servers. They have the capability to initiate communication with other peers to request.